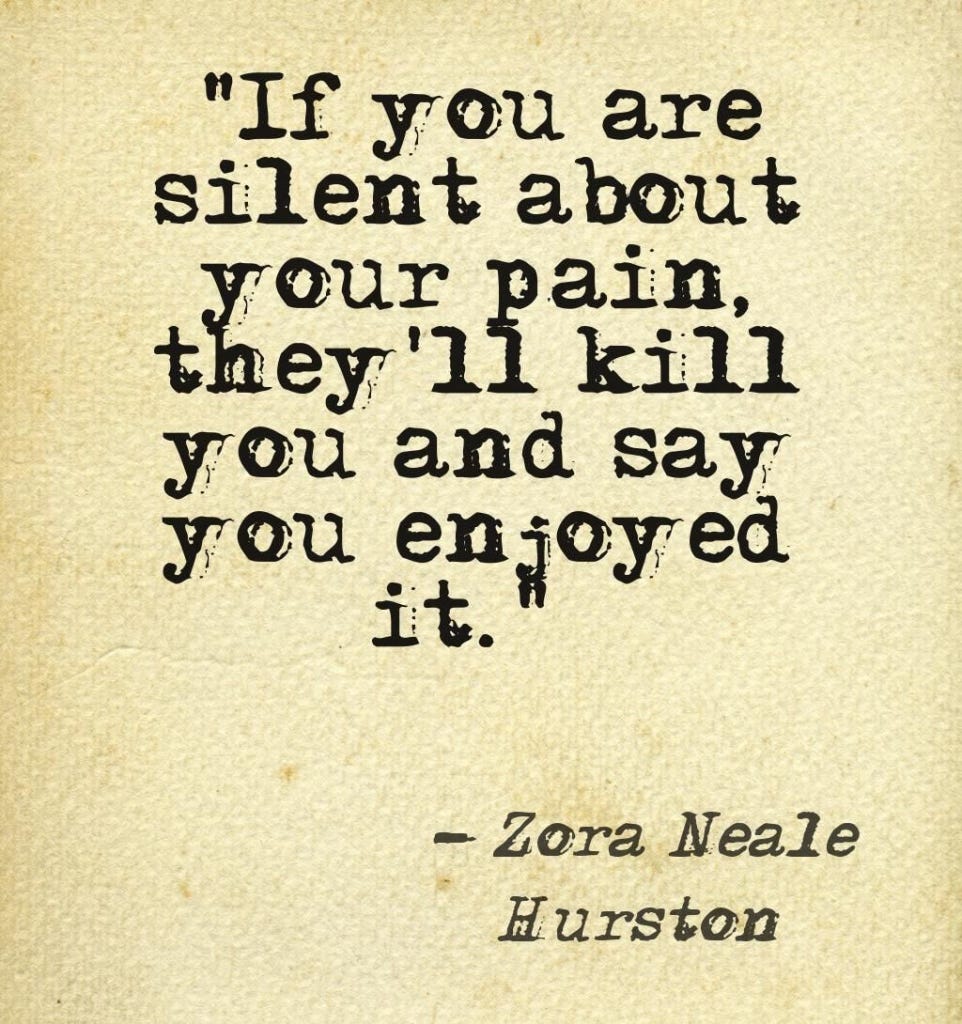

Sistahs, we've been silent too long. We are re-sharing these words of wisdom to both remind you and inspire you regarding the need to put an end to the hatre of Black women, now called 'misogynoir.' As we think of ways that we need to reclaim agency, such as at the intersection of education and economics, we can move from mere rhetoric to true liberation. What do we mean by this?

African descended women carry a disproportionate amount of student loan debt in the US. According to The Education Trust, Black women experience student loan debt more acutely than other racial groups. With fewer resources for repayment, and with many Black women entering higher education as parents, the pressures we experience can be more intensive. In the article, "How Black Women Experience Student Loan Debt," the authors, Victoria Jackson and Brittani Williams, identify "racist" policies in the program creating financial precarity for Black women who pursue college and graduate level degrees. They state,

“Black borrowers are the group most negatively affected by student loans, in large part because of systemic racism, the inequitable distribution of wealth, a stratified labor market, and rising college costs. Because Black women exist at the intersection of two marginalized identities and experience sexism and racism at the same time, they make less money and often need to borrow more to cover the cost of attendance, and struggle significantly with repayment.”

In fact, they reference the Jim Crow Debt as a resources which further examines this phenomenon. Black women in Religious Academia are also more likely to be independent scholars, furthering their precarity and mental health. We may have heard about the policies regarding student debt forgiveness being unfair, but it is important to be armed with all the information. If you or your child are a borrower, please prioritize learning more about debt forgiveness currently available. Research the programs which may already provide relief for forgiveness of your remaining debt such as the "Public Service Loan Forgiveness." Though we are providing links below in the US and UK, we encourage all borrowers to check within their countries for additional information.

Finally, many are unaware that you may have your social security (retirement) garnished - up to 15% for unpaid student loan debt. Speak out about this pain - make calls, write letters and ask for help! If you or someone you know struggles with these issues, please set aside a day to resolve this. It may require your doing this several times before you find a satisfactory resolution. But by facing this, you can improve your own financial and mental health, while possibly protecting your retirement.

We are not financial advisors, but we conducted initial research to see which options might benefit anyone struggling. We have created a link to possible resources below.

The Misogynoir to Mishpat Research Network © 2023

Student Loan Debt Resources (US): https://studentaid.gov/resources,

Student Loan Resources (US): Five Tips, Tools and Resources to Help You Tackle Student Debt,

Student Loan Resources (UK): Options for Paying Off Your Debt